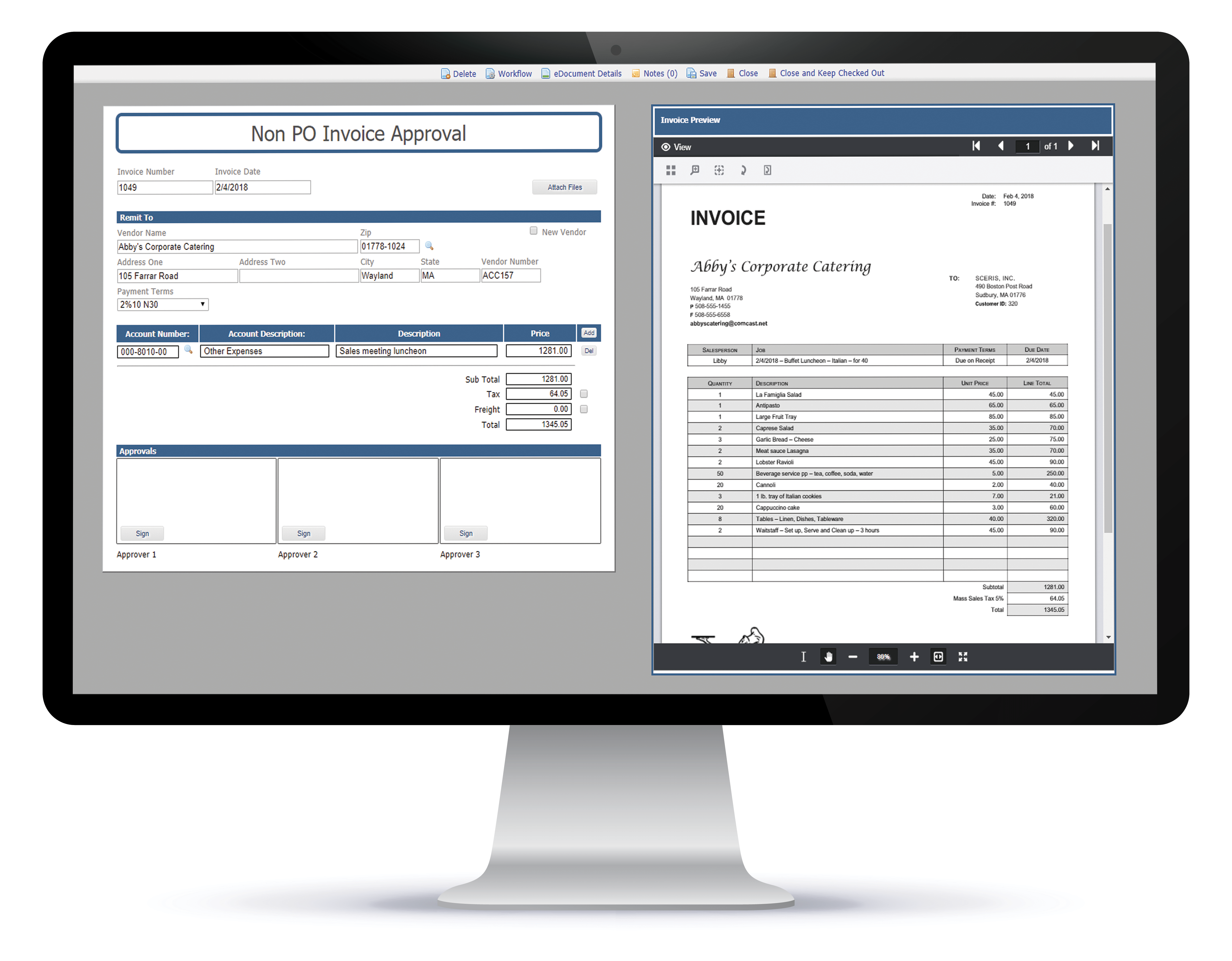

QuickPOST is a fully integrated workflow environment for rapid invoice processing.

Capturing invoice data unique to the invoice is always necessary, such as for the Invoice Number and Invoice Date. Identifying the Vendor ID/# is simplified with a zip look-up into the Master Vendor File. Typically a Zip+4 will get you the matching vendor, but a quick review of the remit-to address downloaded will validate the vendor, or cue the associate to a possible new vendor.

After capturing required data, the associate may apply account coding to the details of the invoice, or that may be a requirement of your managers.

Once completed by the AP associate, just route to the appropriate manager by selecting them from a list or use the Workflow Agent to route based on account codes.

Capturing invoices is accomplished with scanning, importing or automatically importing invoices (such as those submitted to an email address). OCR using Dynamic Data Capture can be used to automate data capture and prefill selected data values. The overriding value of QuickPOST is that invoice processing is “quick” using the features built into each QuickPOST environment.

Data fields are configurable to your unique requirements.

Example QuickPOST Process

| In Production | Description |

|---|---|

| Invoice Number (“TAB”) | Invoice Number: 6 Characters |

| Invoice Date (“TAB”) | Invoice Date: 9 Characters |

| (“TAB”) Zip+4 (“ALT V”)

Sight Verify Vendor Remit-To |

Vendor Selection: 11 Characters |

|

|

|

|

|

|

|

|

|

|

| (“ALT A”) Select Account Code (“TAB”) | Account Code Selection: 2 Characters. To enter the account code, enter “ALT A” for a list that can be filtered and account code selected, then “TAB”. |

| Description (“TAB”) | Description: 23 Characters |

| Amount (“TAB”) | Amount: 8 Characters |

| Additional Detail Lines: If detail must be distributed across account codes, just enter “TAB” after entering the amount to go to the next row. QuickPOST provides for a predetermined number of rows, but if more are needed just select the ADD button to create additional rows. | |

| Sub Total: This is a calculated field | |

| Freight: No Characters. Note the box to the right of Freight; checking the box results in a short pay. | |

| Tax (“TAB”) | Sales Tax: 6 Characters. Note the box to the right of Sales Tax; checking the box results in a short pay. |

| Total: This is a calculated field. | |

| Select Route To from List | Selection (Note: Route to can be automated based on data fields in QuickPOST) |

| Estimated – 64 Characters keyed to post and route |